The Week Ahead 16.10.2023

View the Week Ahead in 60 Seconds

This week’s macro news will be dominated by inflation prints. On the 17th Canadian annual inflation will be released, with the current rate standing at 3.3%. The next day attention will turn to the UK and Europe. Current UK inflation stands at 6.7% however recent GDP data showed that the economy was near stagnant for Q3. Further to that, Chief Economist of the Bank of England, Huw Pill acknowledged that interest rates will be more ‘finely balanced’ moving forward. On the same day, EU core inflation for September will be published. The current rate stands at 5.3% however the expectation is for the rate to fall to 4.5%. And finally on the 20th annual Japanese inflation will be issued. The current rate stands at 3.2% with pressure slowly starting to grow on the Bank of Japan to raise rates.

Earnings

Quarterly results will continue to pour into the market this week with some very recognisable names on show. Up first is the second biggest bank in the US, Bank of America, which was published on the 17th. On the 18th, the world’s largest EV manufacturer, Tesla will announce their Q3 performance. Despite weak growth in China, the largest consumer of EV’s, Tesla stock is still up c.139% this year. It’s also worth keeping an eye on Netflix earnings which are out the same day.

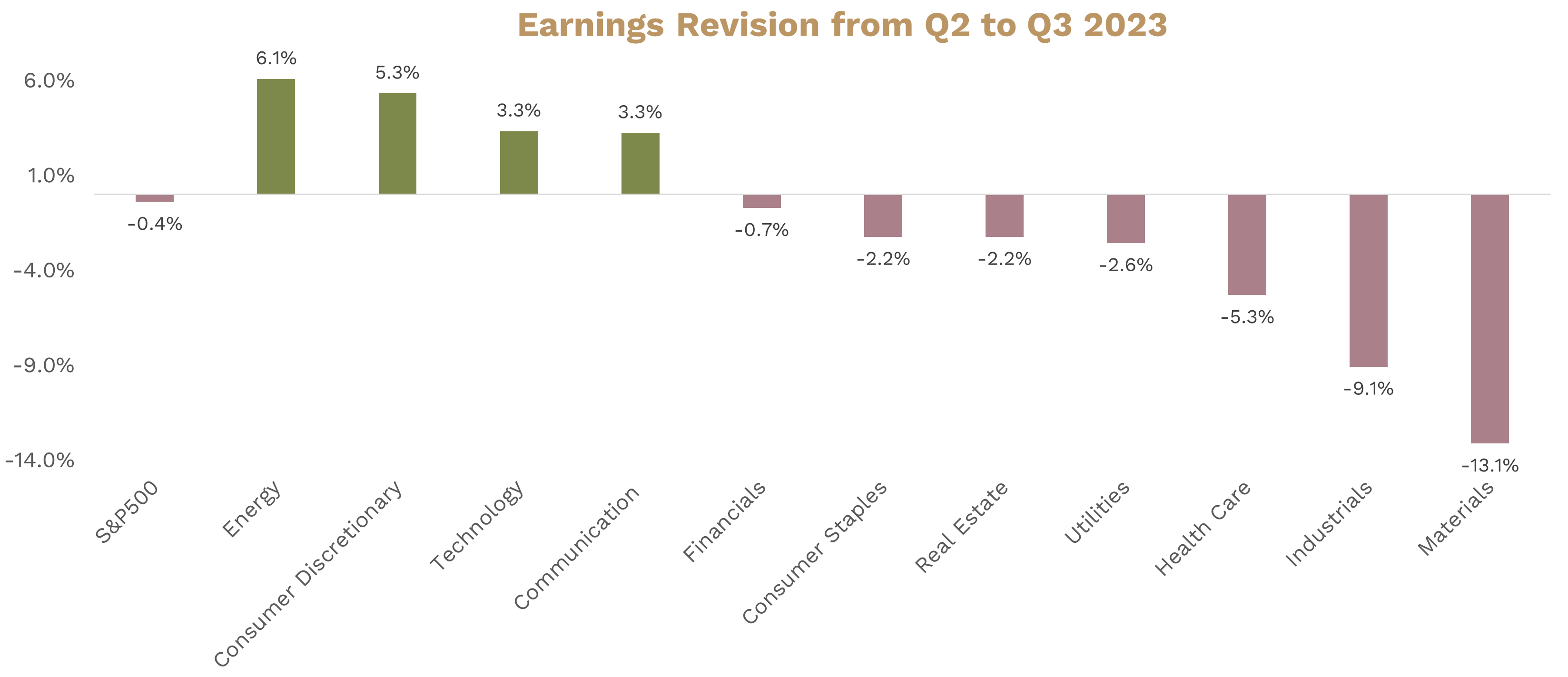

Chart of the Week

Ahead of Q3 earnings, market analysts have revised down their overall quarterly expectation of the S&P500. Higher rates for longer have impacted revisions on high-cost industries such as materials and industrials whilst rising energy prices have pushed energy earnings revisions up.

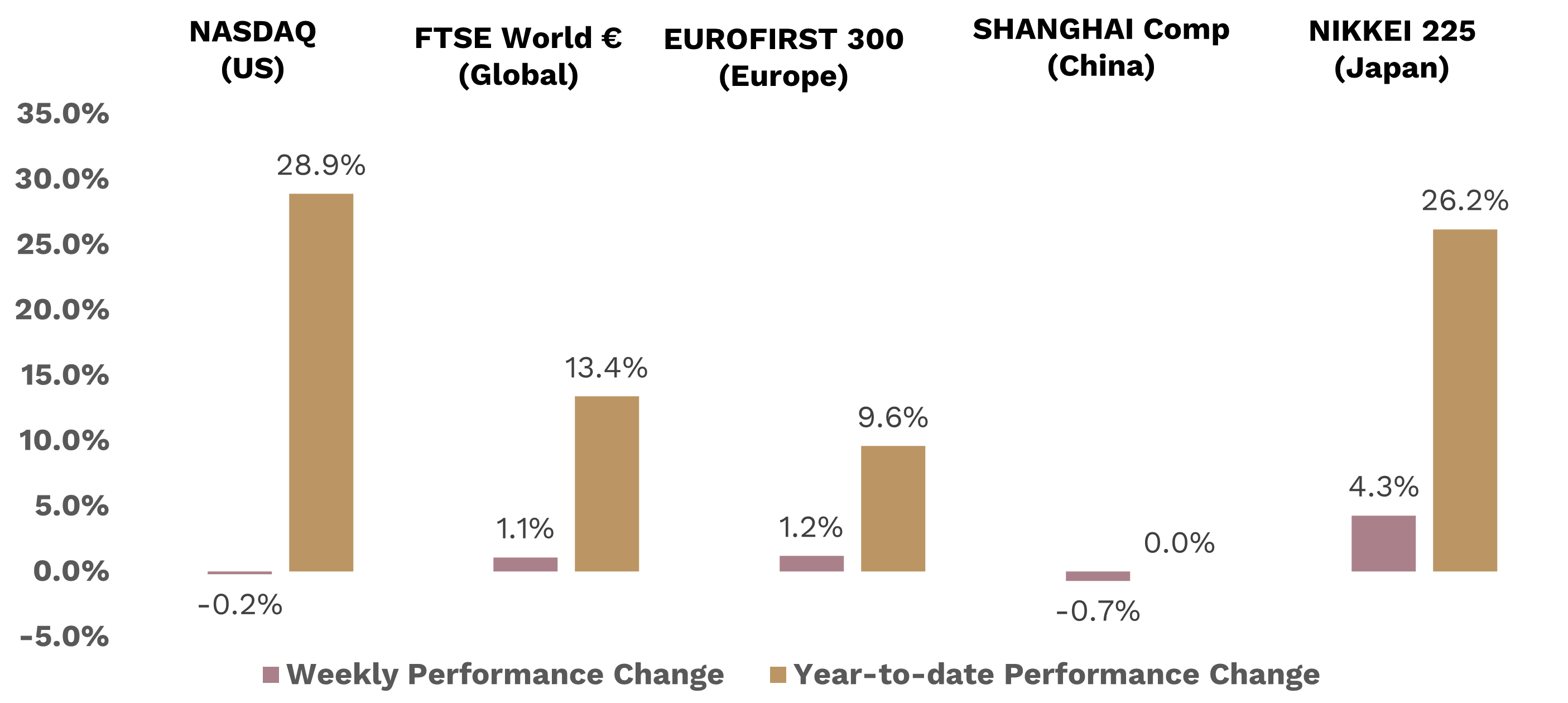

Equities

Weekly global equities chart, tracking the performance of major stock markets.

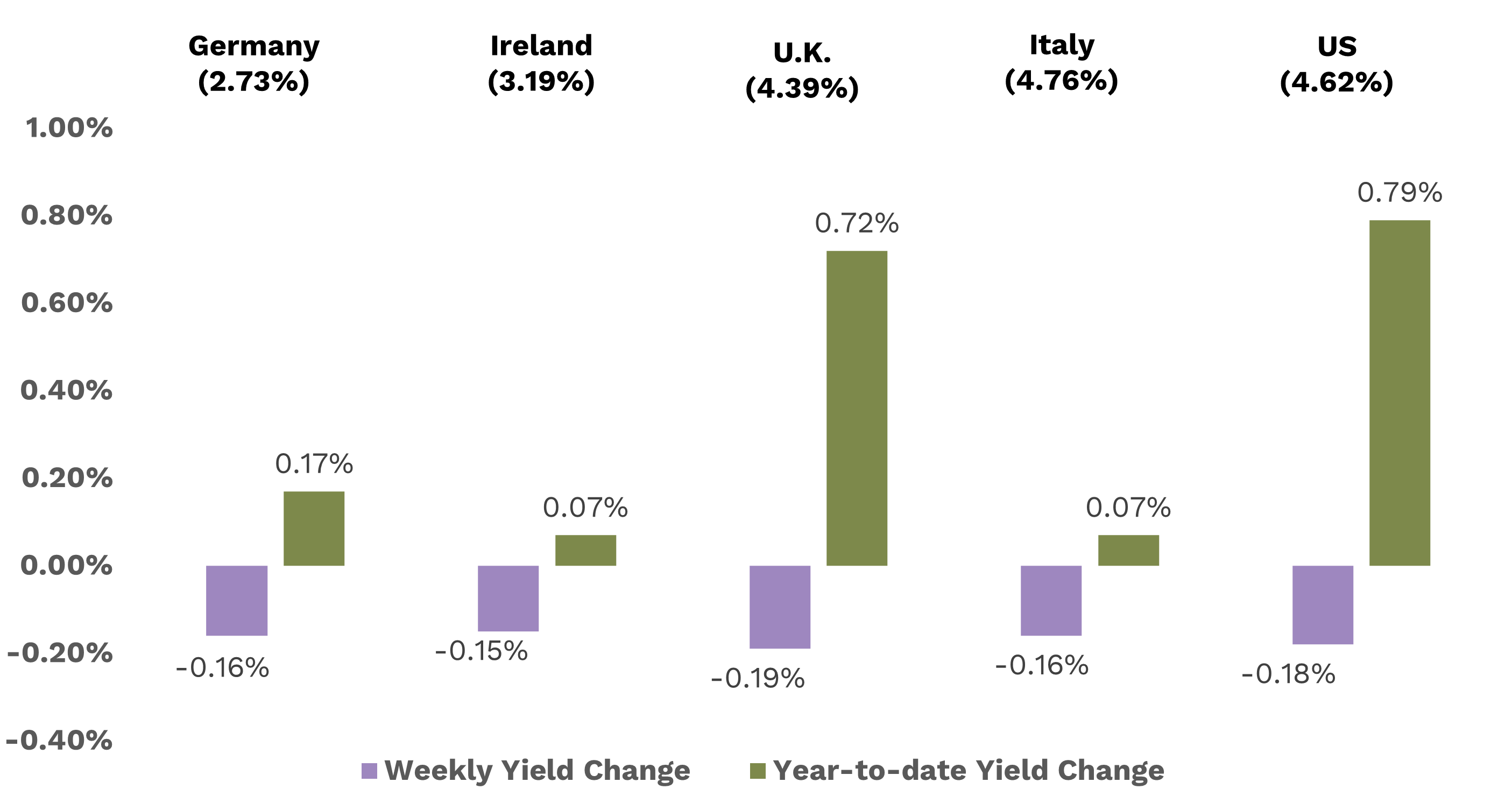

Bond Yields

Monitoring the fluctuations in bond yields across international markets.

How can we help?

At Unio we are always here to help.

If you have any questions on any of the information provided in this update, speak to your Client Manager or contact us at enquiries@unio.ie.