The Weekly View, Week Beginning 23 09 2024

Welcome to the Unio Weekly View for the week beginning September 23rd, our summary of markets and macro news.

- It was a frantic week for macro news with three of the world’s largest central banks making interest rate calls.

- The biggest news was the 50bps cut made by the Federal Reserve, somewhat catching analysts and economists off guard as most had priced in a 25bps cut. The cut, which took the base rate to 5.0%, indicated the Feds growing focus on a softening labour market versus the subsiding inflation challenge.

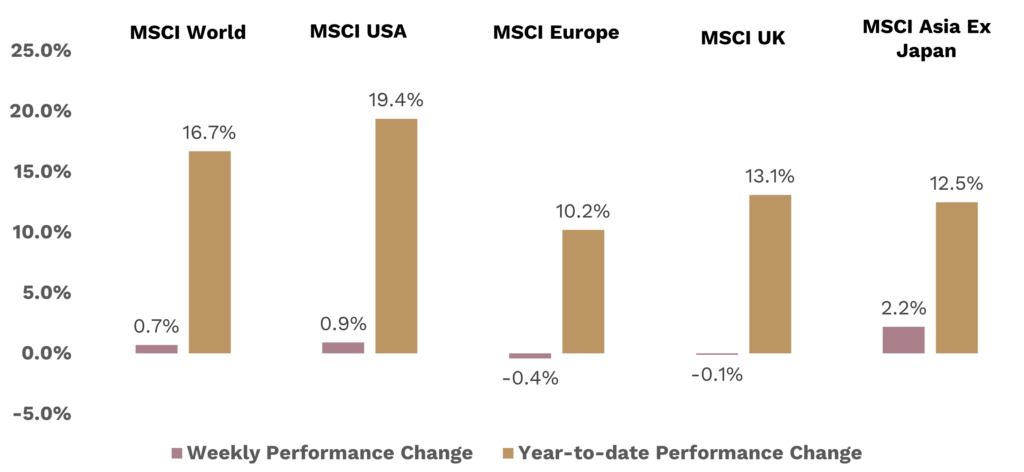

- In the UK, the Bank of England held its base rate at 5.0%, in an 8-1 vote, with uncertainty growing as to the outlook of the UK economy. The same story was true in Japan, with the Bank of Japan holding their base rate at 0.25%. The net result saw global equities rise over the week, up 0.7%.

- The US market drove the returns, whilst both Europe and UK equities were negative on the week. Gold continued its strong rally, up 1.5% whilst crude oil jumped 4.5% due to declining global stockpiles and a sharp interest rate cut from the Fed.

Watch our investment brief for the week ahead.

Chart of the Week

The US 10yr-2yr yield curve “uninverted” as it headed back above 0% for the first time since early July 2022. Stable economic data coupled with a 50bps rate cut from the Federal Reserve gave investors confidence over the future of both short and medium term rates in the US.

Weekly Bonds Chart

Weekly Equities Chart

At Unio Employee Benefits, we are happy to work with our clients to help provide solutions to help bridge these potential gaps for their scheme members. Contact your client manager directly or get in touch at enquiries@unio.ie.